how likely will capital gains tax change in 2021

A capital gains tax break for investing in an opportunity zone is available until 2026. However if you sell or give away an asset worth more than 6000 you could have to pay CGT.

In the United States of America individuals and corporations pay US.

. Federal tax law generally requires lenders or real estate agents to file a Form 1099-S Proceeds from Real Estate Transactions with the IRS when you sell your home unless you meet IRS requirements for excluding capital gains tax. If you own a piece of real estate and sell it for a profit you will owe a capital gains tax. It is mainly the case when a local sell hisher home 5.

Capital gains on gifts of property to qualified donees. Gifts of securities acquired under a security option. 0 15 and 20.

Here are the long-term capital gains tax brackets for 2020 and 2021. Capital Gains Tax On Real Estate. Firstly the house that the resident is selling should be the primary residence 6.

Long-term capital gains tax is a tax applied to assets held for more than a year. Have any deductions to claim such as student loan interest self-employment tax educator expenses. Married Filing Jointly.

If you lived in the property for less than two years and were forced to move speak with your accountant about any partial capital gains. The first capital gains tax was introduced along with the first federal income tax legislation in 1913. However if youre an Australian resident CGT applies to your assets anywhere in the world.

The person residing must meet all criteria to avoid the capital gains tax on a property sale. Certain capital gains from graduated rate estates. Federal income tax on the net total of all their capital gainsThe tax rate depends on both the investors tax bracket and the amount of time the investment was held.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. According to the Internal Revenue Service you might not have to pay taxes on the sale of. Non residents pay capital gains tax of 25 of the profit capital gain realized on the sale so long as the payment is accompanied with the Application for a Clearance Certificate Form T2062.

The rates for long-term capital gains taxes are 0 15 and 20 depending on the tax bracket the owner claimed while filing their tax return for that year. New data published by HMRC shows that in the 2020 to 2021 tax year a total of 143 billion was paid in Capital Gains Tax by 323000 taxpayers. The additional ordinary income is pushing capital gains out of the 0 long-term capital gains tax bracket into the 15 tax bracket.

Not all countries impose a capital gains tax and most have different rates of taxation for individuals versus corporations. Your capital gains tax rate as a single person is 15. Part of total capital gains that is exempt from Canadian tax under a tax treaty.

Capital Gains Tax Rates. If you are a foreign resident or a temporary resident. For example if you had 10000 of additional ordinary income you would pay an additional 12 of ordinary income taxes and it would push the 59250 of long-term capital gains taxed at 0 to 49250.

Currently the maximum capital gains rate is 20. Add this to your taxable income. Research indicates that consumers can and do leave high-tax areas to make major purchases in low-tax areas such as from cities to suburbs.

Capital gains tax is due on 50000 300000 profit - 250000 IRS exclusion. How do I calculate my capital gains. A capital gains tax CGT is a tax on the profit realized on the sale of a non-inventory assetThe most common capital gains are realized from the sale of stocks bonds precious metals real estate and property.

Capital gains tax CGT is one of the least common taxes on income and for many it wont apply. This simple income tax calculator will instantly tell you how much tax you need to pay based on your income for the 202122 financial year. Capital Gains Tax for foreign investors.

Lets discuss how to offset capital gains. April 29 2021 Investment Taxes. IF YOU owe AMT or need to make an excess advance premium tax credit repayment.

You know that long-term losses can. Capital gains rates jump to 20 for those with income above the 441451 mark. But this range will change depending on your marriage filing status.

Security options deductions under paragraph 1101d 5570. The total tax amount will depend on a variety of factorsmost notably by the type of asset being sold. 1099-S form to report your capital gains.

But just in case. From the total purchase cost of the home subtract the amount you spent on renovations closing costs agent fees etc. It doesnt apply for main homes cars or lotterypools winnings among other things.

Proponents of maintaining a relatively low capital gains tax rate argue that lower rates make investing more. 53 Proposed revisions Legislation will be introduced in Finance Bill 2022-23 that will provide that. From the amount you will make.

You likely know that you can offset your capital losses against your capital gains to reduce your net taxable gain. THEN USE Schedule 2 Part I. THEN USE Schedule 1.

Also Capital Gains Tax doesnt apply to depreciated assets used solely for taxable purposes such as business equipment or fittings in a rental property. There are two main categories for capital gains. Remember this isnt for the tax return you file in 2022 but rather any gains you incur from January 1 2022 to December 31 2022.

Long-term capital gains are taxed at only three rates. How will capital gains and losses apply to me. IF YOU have additional income such as capital gains unemployment compensation prize or award money gambling winnings.

If the non-resident seller does not inform the CRA of the sale by the deadline heshe will be subject to a penalty of 25 for each day the. After that transfers are treated as normal disposals for capital gains tax purposes. Short-term capital gains are taxed at the investors ordinary income tax rate and are defined as investments held for a year or less before being sold.

Avoidance of sales tax is most likely to occur in areas where there is a significant difference between jurisdictions rates. If you are already a capital gains tax guru you can skip the rest of this article. The UK outlines a few circumstances that make evading capital gains tax on a property sale possible.

Short-term capital gains are taxed at your ordinary income tax rate. The long-term capital gains tax rates are 0 percent. Whether for a change of job health issue or other unforeseeable events.

A capital gains tax is a tax on the profit that you make when you sell something for more than you paid for it. First deduct the Capital Gains tax-free allowance from your taxable gain. Capital gains tax rates have fallen in recent years after peaking in the 1970s.

It needs to. The Role of Competition in Setting Sales Tax Rate. For example evidence.

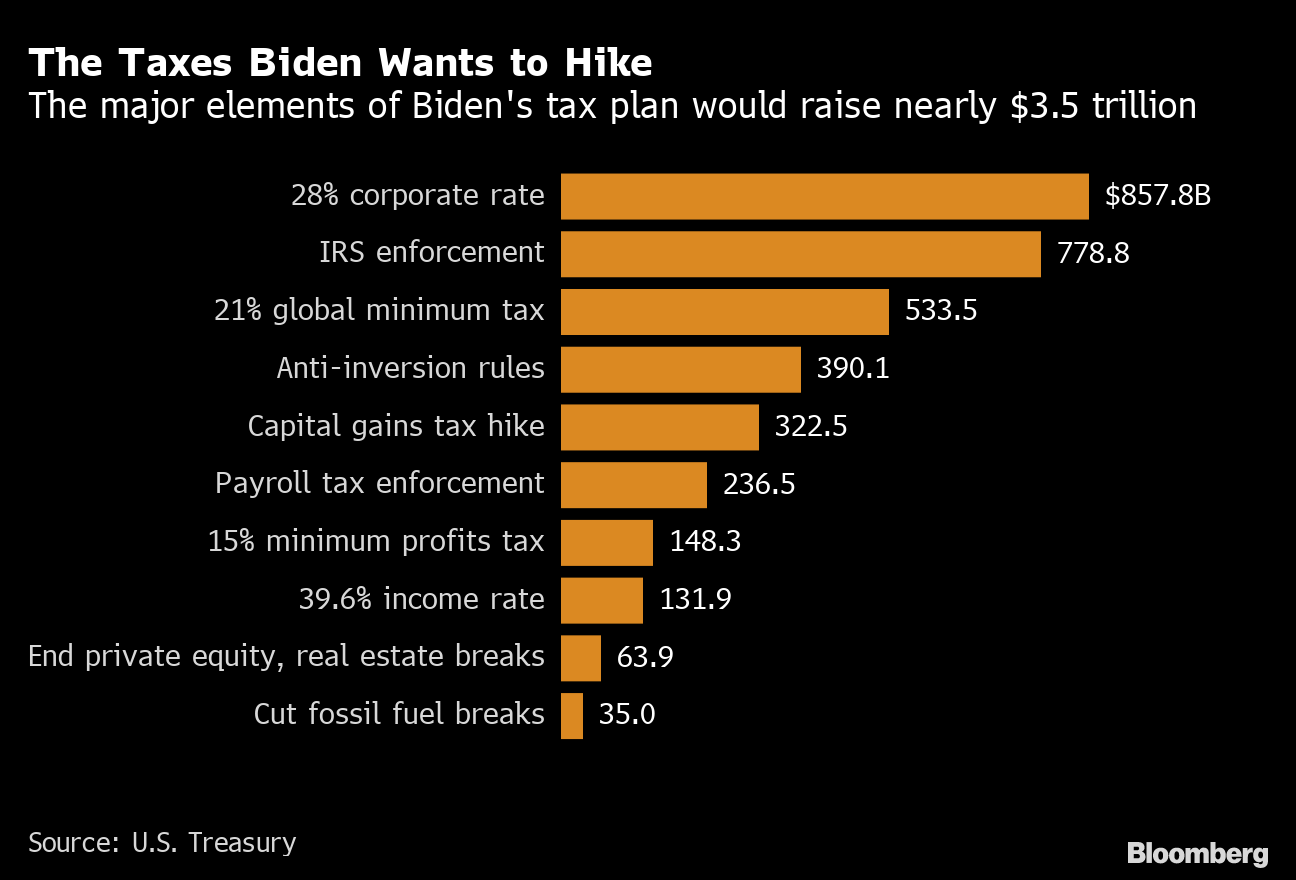

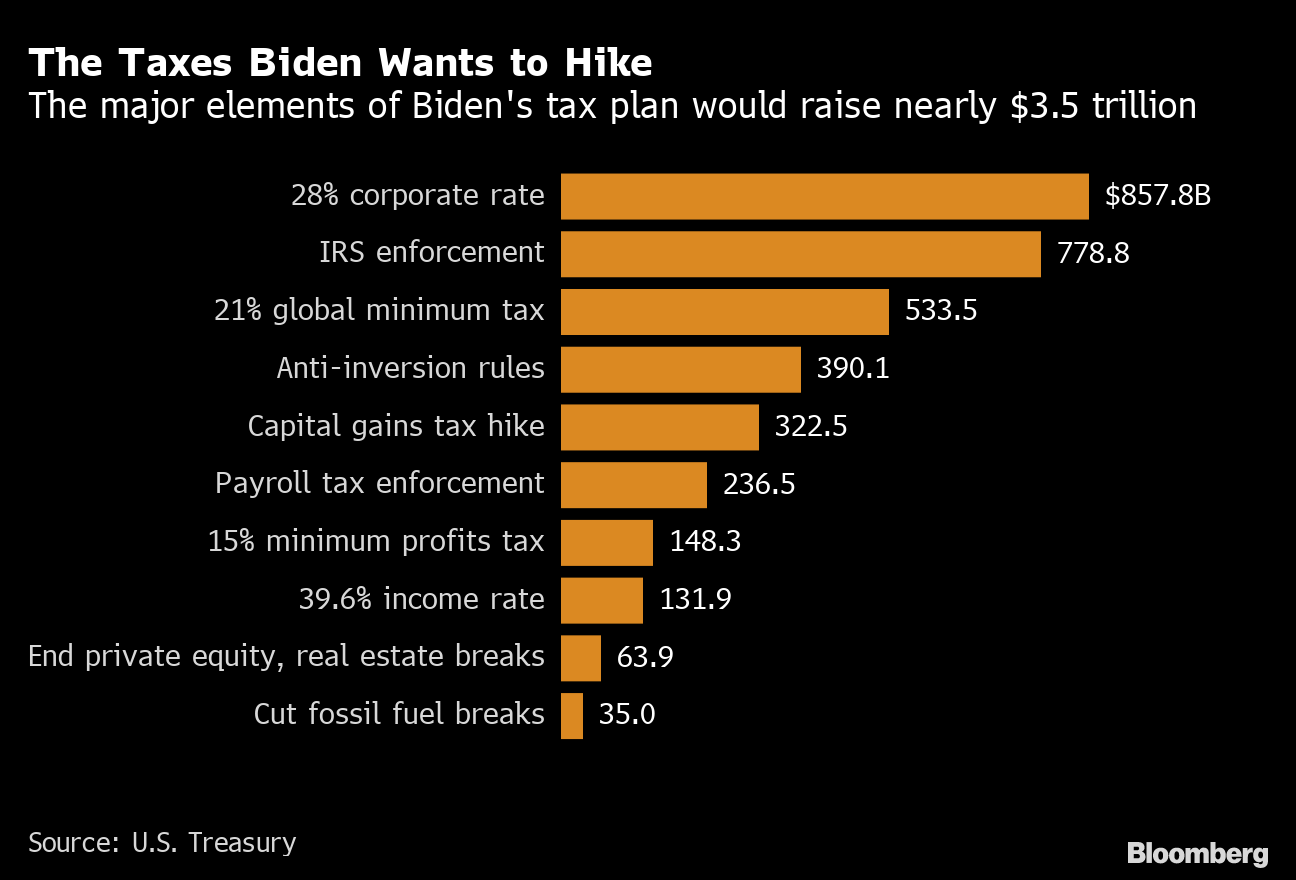

How Rich Americans Plan To Escape Biden Tax Hikes Ppli Is A Perfect Loophole Bloomberg

Capital Gains Roundup 2021 Edition Morningstar

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Capital Gains Roundup 2021 Edition Morningstar

Capital Gains Roundup 2021 Edition Morningstar

Trust Tax Rates And Exemptions For 2022 Smartasset

How Do Marginal Income Tax Rates Work And What If We Increased Them

Can Capital Gains Push Me Into A Higher Tax Bracket

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Solved Can You Avoid Capital Gains Taxes On A Second Home

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Income Tax Law Changes What Advisors Need To Know

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Roundup 2021 Edition Morningstar

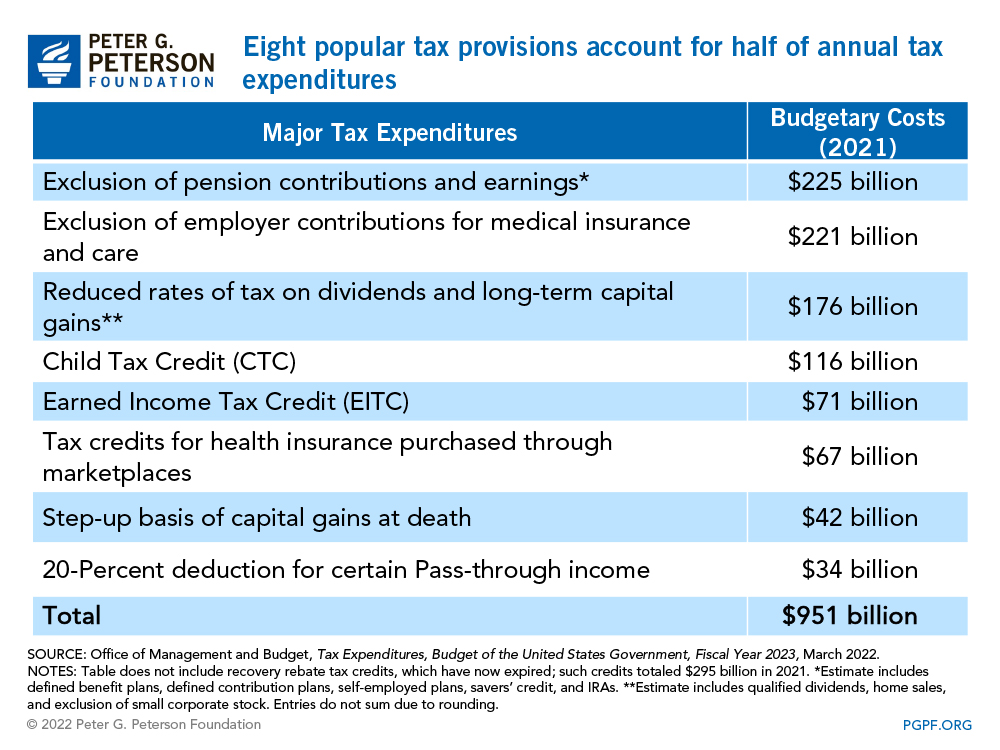

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)